Perspectives

The Healthcare Consumer of the Future Has Arrived: Mid-Pandemic Consumer Sentiment

COVID-19 will be forever be remembered as the event that shocked the world and permanently changed consumer behavior and sentiment, particularly around healthcare. While the initial onset of the pandemic incited crisis-like fear and panic, consumers have quickly adapted to their new reality. Despite major disruption to their daily routines, consumers have embraced new care delivery options and technology solutions to support their evolving health needs. This ‘new normal’ presents a major opportunity for digital health companies to seize a captive audience of consumers open to engaging in new ways to manage their health and wellness.

Prior to the pandemic, consumer engagement with digital health was lackluster, despite their stated interest. While 66% of consumers reported a willingness to use telehealth, only 8% of consumers had ever actually used telemedicine prior to 2020. This discrepancy can be attributed to a variety of factors – limited availability, low awareness, or simply consumer routines tied to in-person care. Pre-COVID-19, consumers were much more comfortable with face-to-face care: 52% of consumers would go to the emergency department for care in the middle of the night, while only 18% would choose telehealth.

Fast-forward to the pandemic where we saw consumer behavior radically change within just a couple weeks. COVID-19 brought pervasive economic hardship, concerns about health and safety, and a shift to a home-based lifestyle. Consumers cut back on spending, including on healthcare visits and medications, and shifted much of their purchasing to e-commerce. Many thought twice about entering a healthcare facility – 43% of consumers who delayed care reported being afraid to enter a medical facility due to COVID-19.

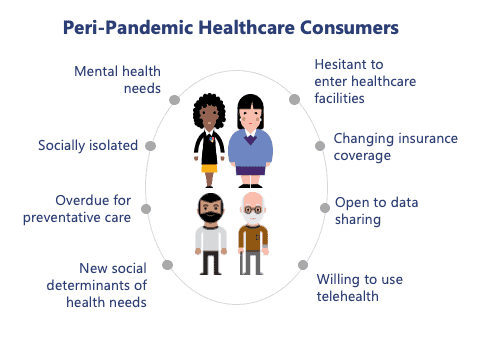

As a result of these major behavioral shifts, the peri-pandemic healthcare consumer looks drastically different than the healthcare consumer just a mere six months ago.

The Peri-Pandemic Healthcare Consumer

Consumers are plagued with new health and social needs along with new challenges in accessing care. However, with this new environment comes a silver lining: engagement and comfort with digital health that serves as a lifeline during these unprecedented times.

Consumer wellbeing has taken a heavy toll, with 53% of individuals reporting declining mental health during the pandemic. The elderly in particular are facing extreme social isolation and loneliness, which has had a profound impact on their physical health. Further, access to existing care channels and preventative care has been disrupted. More than half of consumers reported having delayed care and 77% of patients had their clinical trials suspended or delayed, hindering access to potentially lifesaving treatments.

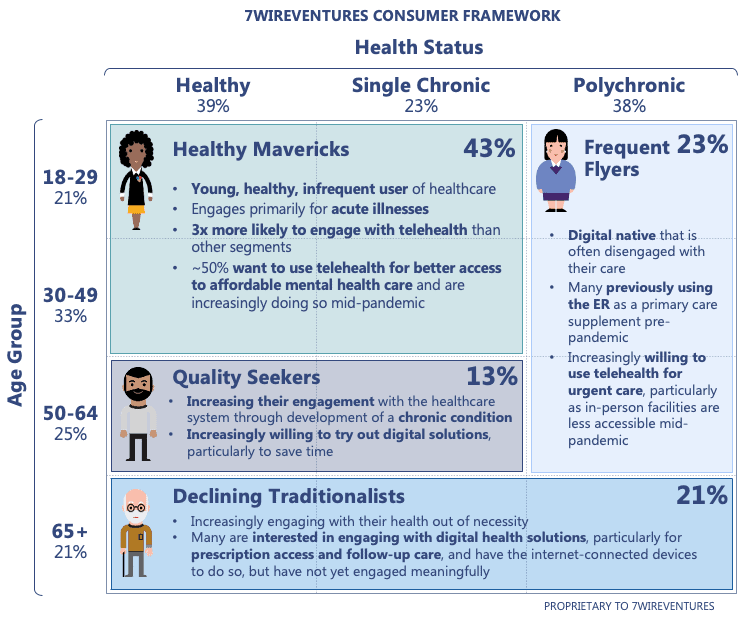

To evaluate consumer sentiment, we at 7wireVentures segment healthcare consumers based on their age and health status. Each of these segments has varying needs, behaviors, and experiences with digital health and has been affected by the pandemic in unique ways.

![]() Healthy mavericks – these young and healthy consumers were already engaging with telehealth for their acute needs. However, they are experiencing declining mental health, burnout from personal and professional duties, and unhealthy habits while stuck at home.

Healthy mavericks – these young and healthy consumers were already engaging with telehealth for their acute needs. However, they are experiencing declining mental health, burnout from personal and professional duties, and unhealthy habits while stuck at home.

![]() Frequent flyers – those who are polychronic and often disengaged with their health are left without access to their typical care channels, such as emergency rooms, due to the heightened risk of COVID-19.

Frequent flyers – those who are polychronic and often disengaged with their health are left without access to their typical care channels, such as emergency rooms, due to the heightened risk of COVID-19.

![]() Quality seekers – middle-aged consumers experiencing the onset of chronic conditions, are experiencing new difficultly accessing their normal channels of care, such as their primary care physician, and are struggling to manage these new conditions from home.

Quality seekers – middle-aged consumers experiencing the onset of chronic conditions, are experiencing new difficultly accessing their normal channels of care, such as their primary care physician, and are struggling to manage these new conditions from home.

![]() Declining traditionalists – those that are over 65 years of age are at the highest risk for COVID-19 and are adjusting their behaviors accordingly. This consumer segment must take great precautions to self-isolate, but with this comes increasing loneliness and subsequent increased risk for conditions such as dementia and stroke.

Declining traditionalists – those that are over 65 years of age are at the highest risk for COVID-19 and are adjusting their behaviors accordingly. This consumer segment must take great precautions to self-isolate, but with this comes increasing loneliness and subsequent increased risk for conditions such as dementia and stroke.

Across all segments, healthcare consumers are dealing with medication shortages, delayed care, and social isolation. However, as the consumer sentiment evolves they are increasingly aware of mental health challenges and are more willing to engage with providers remotely to allow for continued access to care. Those with chronic conditions, in particular, are looking for guidance on managing their care regimens at home. Consumers across all segments are also more likely to engage with the digital solutions offered by their health plans. Ultimately, consumers are increasing their involvement with their health, particularly frequent flyers and declining traditionalists, two groups that have historically been very difficult to engage outside of the hospital.

While many of these changes have strained our healthcare system, they also pose an immense opportunity for digital health to improve the quality, cost, and experience of care. As one example, consumer engagement with digital solutions has increased access to highly valuable patient reported data and biometric information, arming providers with improved visibility into their patient’s health. Other significant benefits of increased digital health engagement include improved access to mental health services, more efficient clinical trials, quicker access to specialty care, and the use of more convenient care settings.

7wireVentures Predictions

While some tailwinds may dissipate, we believe much of the consumer, provider, and regulator behavior changes will remain, in support of continued access to digitally enabled healthcare.

1. While consumers will shift some of their healthcare needs back to face-to-face care delivery, telehealth engagement will remain. Survey data indicates that 76% of consumers report being highly or moderately likely to use telehealth moving forward, and 74% reported high satisfaction with the services they have received. While recent data shows that telehealth visits have slightly slighted declined to 21% of total visits in July from a high of 69% in April, we expect telehealth rates to remain much higher than they were pre-pandemic (less than 0.01%). Consumers will increasingly engage beyond their acute needs to receive services such a primary care, musculoskeletal care, and peri-surgical consultations virtually.

2. Provider comfort and experience with digital health solutions will continue to enable lasting consumer engagement. Provider sentiment on the topic of telehealth has changed dramatically. A recent McKinsey survey indicated that 57% of providers now view telehealth more favorably than they did before the pandemic, and 64% are more comfortable using it. Tele-triage, for example, has seen increased adoption to reduce waste and improve quality of care.

3. Payers and regulators will continue to support these behavioral shifts through lasting reimbursement changes and modified requirements. Payers will leverage data collected from increased virtual health engagement to further initiatives that have proven to impact cost, quality, and member experience.CMS will continue to support long-term reimbursement and eligibility changes that enable continued access to virtual care. And while lasting reimbursement parity and telehealth delivery across state lines will require an act of Congress, bipartisan support for such measures already exists.

The state of the healthcare consumer has undergone dramatic transformation throughout COVID-19 – consumers have new, evolving healthcare needs and are more willing than ever to engage with innovative, digitally-enabled models of care. The healthcare consumer of the future is progressing much more quickly than we anticipated. Digital health has a unique opportunity to tailor solutions to meet the new preferences and needs of this consumer. We are optimistic about the industry revolution that will occur as the power of digital health is fully harnessed both during this current wave of increased consumer adoption, and also in the post-pandemic future.