Perspectives

The Doctor Will “See” You Now: The Emergence of Tech-Enabled Care Delivery Models

Care delivery has undoubtedly gone through an evolutionary leap. Gone are the days when healthcare was predominantly delivered from a brick and mortar hospital. Tremendous advancement in our understanding of modern medicine has also meaningfully improved care quality, medical outcomes, and survival rates. Yet at the same time, many of the hallmarks and challenges of care delivery remain the same: services are primarily reimbursed via fee-for-service, many services occur in facilities that are inaccessible or inconvenient for most consumers, sharing data across providers is exceedingly challenging, and the consumer experience of receiving care is often confusing and fragmented.

Fortunately, in the last decade, we have seen a boom of digital health startups looking to disrupt care delivery and create a more consumer-focused, holistic, value-based model. These companies are accelerating our healthcare system towards one that empowers consumers and better coordinates care across multiple dimensions, including mental and physical, preventative and curative, and in-person and virtual. The rise of these new care models has been powered by the development, advancement, and growing adoption of healthcare technologies. Solutions such as remote monitoring devices, telehealth platforms, interoperability solutions, and connected diagnostic devices have all enabled care to extend the reach beyond the four walls of the hospital.

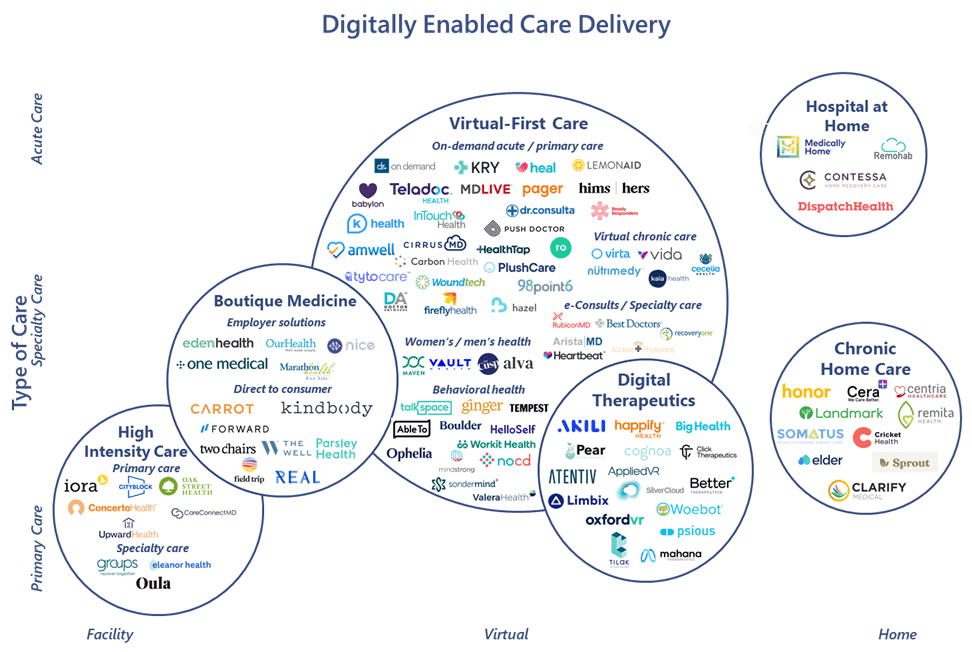

Digitally Enabled Care Delivery Landscape

At 7wireVentures, we define digitally enabled care models as those that combine technology with healthcare services to empower an Informed Connected Health Consumer.

This landscape poses a sizeable market opportunity; new investment in the space has fueled the development of many of these solutions, with private investment in digitally-enabled care models steadily increasing over the past eight years. The past three years in particular have been characterized by a significant surge in funding, with total private investment in care delivery companies in 2019 reaching upwards of $2.3B, more than double the funding total just two years prior.[1] This growth in capital is primarily attributable to larger, later stage deals — as digital health companies founded in the past decade have matured, the market has matured with them, bringing more activity from later stage investors. As a result, median deal size has also grown, more than doubling from 2018 and reaching a high of $8.5M in 2020.[2] This year in particular is shaping up to be a notable year for the segment, with COVID-19 generating increased need for digital care delivery solutions. We have already seen later-stage companies such as Iora Health, Dispatch Health, and Lyra raising mega, $100M+ rounds, signaling interest from a broader financing market. Several notable company exits from earlier market entrants also transpired, including the IPO of Amwell, the IPO of One Medical, the IPO of Oak Street Health, and the merger of Livongo (our 7wire Hatch) and Teladoc, representing the largest transaction in digital health history.

At 7wireVentures, we view this growing digitally-enabled care delivery market through the lens of six primary categories: Boutique Medicine, High-Intensity Care, Virtual-First Care, Chronic Home Care, Hospital-at-Home, and Digital Therapeutics.

Boutique Medicine: Consumers are increasingly seeking and expecting more personalized, convenient, and on-demand healthcare services. As a result, multiple companies have emerged in the past decade to deliver premier care by charging additional cost through subscriptions, fee-for-service, or package pricing models paid largely by consumers or employers. While many boutique medicine providers have laterally expanded to incorporate virtual care into their models, the majority of players still largely leverage an in-person clinic component such as One Medical and Forward. While these companies and other early market entrants initially focused on primary care, more recently, newer companies such as Kindbody, a fertility and gynecology services provider, are entering the market with the promise of offering end-to-end specialized concierge services. Across the market however, critics continue to raise ethical concerns about how boutique medicine exacerbates inequalities in health quality and access. As a result, companies such as SteadyMD and Plush Care have emerged to offer virtual-only care to reduce costs and enable affordable membership models, without sacrificing quality.

High-Intensity Care: By delivering high-touch and preventative services, high-intensity care providers have demonstrated success in averting downstream acute episodes for high-risk populations, reducing hospital admissions by as much as 50%. Ultimately, companies in this sector are aimed at controlling costs, often entering into risk-bearing contracts to manage vulnerable, chronic and co-morbid, or elderly patients. Recognizing the success of high-profile players such as Iora Health and Cityblock Health, major health systems including Stanford Medicine and Mount Sinai are now launching their own value-based, high-intensity care models. However, given the inherent high-operational costs of these models, many players like Oak Street Health have remained focused on delivering care to specific populations such as Medicare Advantage members — a population that is well compensated for by CMS and commercial plans. As a greater number of Medicaid members are covered by managed care contracts, we expect companies in this sector to expand and enter into agreements to cover these higher-need, vulnerable populations.

Virtual-First Care: COVID-19 has dramatically accelerated the adoption of virtual care, with some companies reporting 300% growth in the number of consumers using telemedicine and a 50x+ reported increase in the number of provider virtual visits. Given the rise in pandemic-induced and exacerbated mental health disorders, virtual-first care has particularly gained significant traction among behavioral and psychiatric health applications. 7wireVentures portfolio company NOCD, for example, which specializes in personalized telehealth services for obsessive-compulsive disorder (OCD), reported doubling their therapy sessions since the start of the pandemic. Tele-therapy is not the only specialty case with rapid spikes in growth — gastroenterology, rheumatology, and orthopedic surgery were among the top specialties adopting telemedicine in the early stages of COVID-19. 7wire portfolio company RecoveryOne, is another example, providing specialized virtual care for individuals to recover from musculoskeletal conditions. In light of this trend, Access Physicians and RubiconMD are expanding virtual access to specialists through e-consultations for patients and primary care providers alike. Given greater provider and consumer comfort with virtual care, relaxed regulations around telehealth, and a projected provider shortage across primary care and select specialties in the U.S., both patients and providers will rely more heavily on virtual care models moving forward.

Chronic Home Care: COVID-19 has also accelerated adoption of at-home care, particularly for consumers with chronic conditions who are at higher risk for infection and may benefit from remote monitoring for always-on support. Home care models offer multi-faceted benefits including better outcomes and an improved experience at a meaningful reduction in costs, with up to 90% of patients preferring to receive care at home. Cricket Health is one such company offering kidney care services for people with chronic kidney disease, with a focus on increasing home dialysis adoption through tech-enabled care. 7wire portfolio company Clarify Medical is another example, equipping consumers to self-deliver treatment at home for chronic skin disorders, such as psoriasis, through a connected handheld UVB phototherapy device. Chronic home care models have also emerged to address various mental and behavioral problems. For example, Sprout Therapy enables the delivery of ABA (Applied Behavior Analysis) therapy for pediatrics and adults suffering from autism spectrum disorder, meaningfully improving the experience by eliminating access barriers for families seeking ongoing, sometimes daily, care.

Hospital-at-Home: Beyond caring for chronic conditions remotely, certain acute care services that are ordinarily confined to the hospital setting can also be delivered at home. Hospital-at-home providers offer multiple advantages over traditional health systems, including lower cost and potentially reduced safety risk. Growing acceptance of the hospital-at-home model has also been aided by CMS’ recent decision to allow hospitals to receive payment for outpatient services delivered at home. In fact, several leading health systems have recently launched their own hospital-at-home programs, with some developing their own platforms, while others are partnering with technology and operations enablers like Medically Home. Though the most nascent category, representing only 3% of total private funding, hospital-at-home companies have received outsized attention during the pandemic and are some of those most likely to benefit from recently secured or expanded contracts such as that between Medically Home and Tufts Medical Center as well as Contessa Health’s expansion with Allegheny Health Network.

Digital Therapeutics: Digital therapeutics are a growing category of tech-enabled care that uses clinically validated software to treat disease. Over time, two schools of thought have evolved in the sector – companies that elect to pursue FDA clearance as a prescribed therapeutic and those that do not. Though both strategies have demonstrated success, solutions pursuing regulatory approval received a hall pass from the FDA in the early stages of the pandemic when the agency temporarily waived requirements to rapidly get digital health tools into the hands of consumers. With Pear Therapeutics leading the way in this sector, newer companies like Sentio and AppliedVR are now gaining momentum with their digital therapeutics for various behavioral health or pain management conditions. Despite these regulatory tailwinds, success of digital therapeutics will largely be influenced by CMS and commercial health plans’ willingness to reimburse for these solutions. Employer wellness plan providers, who have shown more recent interest in adopting digital health tools that help with cost-containment, will also be critical in accelerating the adoption of non-FDA approved solutions.

7wireVentures Predictions

PREDICTION 1: The advent of innovative care models will enable payers and employers to play an increasingly active role in care delivery, meaningfully accelerating the shift to virtual-first care.

Payers and employers have increasingly recognized that cost-sharing can only do so much to contain healthcare expenditures. In order to impact cost, quality, and convenience, payers and employers will expand investment and partnerships with innovative care delivery solutions, pushing beyond onsite clinics to new virtual care models. These organizations will also prioritize partnering with solutions that enable lower cost, remote management of higher cost individuals with chronic conditions, as well as those that emphasize mental health and wellness, accelerated by the increased attention on behavioral health challenges exacerbated by COVID-19. As these organizations observe greater utilization of digital services, they may also rethink benefit design to encourage virtual-first plan options. Teladoc, for example, has indicated that it is in discussions with multiple payers regarding virtual-first plan designs. Recently established programs such as ExpressScript’s digital health formulary will encourage employer adoption of digital health solutions and simplify the process for employers to include digital therapeutics into their health plans. Employers will also continue to offer boutique medicine solutions as a covered benefit to improve talent retention.

PREDICTION 2: Bolstered by recent rapid shifts in consumer and provider preferences, COVID-19 will significantly accelerate the adoption of digitally-enabled, home-based chronic care models, resulting in a rebalancing of care delivery away from facilities.

Aging-at-home will become even more widespread, powered by changes in consumer preferences and new digital tools that empower seniors and their caregivers to receive chronic or end-of-life home care. While two-thirds of Americans believe their loved ones will be able to meet their long-term care needs, the country’s aging population will create a caregiver gap, which will open up new opportunities for chronic home care companies to step in. Likewise, ongoing services such as dialysis and infusions will continue to shift from outpatient facilities to the home. While regulatory reforms in recent years have created incentives to encourage services at home such as home-based dialysis, COVID-19 will serve as an opportunity for the industry to potentially move far more patients to at-home care.

PREDICTION 3: Early-stage private investment in tech-enabled care models will shift toward more nascent categories that enable care delivery methods to meet consumers where they are.

While private investment has historically favored virtual-first care, with the category receiving 60% of total digitally-enabled care delivery funding, the relative saturation and maturity of the market may lead early-stage investors to turn their attention to markets with whitespace. As the shift to value-based care accelerates and patients increasingly gain comfort receiving care at home, adoption rates for solutions in sectors such as hospital-at-home or chronic home care will likely sustain and grow. This system-wide shift to home care, coupled with the growing body of clinical research supporting such models and the relative scarcity of technology companies in the space, will pique investor interest and favorably position companies for institutional investment.

While innovation in care delivery has made great strides, there is still an opportunity to move closer towards a world where consumers will be empowered with greater convenience, personalization, and equitable quality of care. Fortunately, there is great promise both from mature digital health players and newer entrants seeking to streamline the care journey and even reinvent how care is delivered in the future.

[1] Pitchbook data

[2] Pitchbook data