Perspectives

Transforming Consumer Health: How Digital Health is Catalyzing Change in Weight Management

Obesity is one of the nation’s most prevalent health issues; its impact is pervasive within our society – from direct medical spending to links with other chronic diseases (e.g., heart disease, stroke, and diabetes) to societal and emotional effects. Strikingly, 1 in 6 deaths in the US are related to excess weight or obesity. These impacts are exacerbated by the fact that our health system has historically failed to recognize obesity as a chronic medical condition, resulting in generations of consumers who have suffered from lack of access to treatment and care.

The challenges associated with excess weight have accelerated over the past several decades. Prevalence of obesity in adults has grown from 14.5% in 1975 to 41.9% in 2020, and childhood obesity has more than tripled since the 1970s. In parallel, rates of cardiometabolic conditions such as diabetes and hypertension have also increased dramatically. This has resulted in obesity-related cardiovascular disease deaths tripling between 1999 and 2020.

Further, due to the numerous non-medical factors that impact health, the most vulnerable Americans are most likely to suffer from obesity. Lack of access to nutritious, affordable food is a key driver of obesity rates within a community. Black communities are disproportionately situated in food deserts – one in five Black households is in a food desert. The lack of supermarkets / grocery stores can force rural residents to rely on less nutritious food from sites such as gas station convenience stores. Available nutritious food is also less affordable and accessible than alternative options, such as fast food. Compounding this is the fact that persistent stigmas may deter people suffering from obesity from seeking out care. Society often associates obesity with laziness, irresponsibility, and lack of control; health care providers can perceive those who are experiencing challenges with their weight as non-compliant and lacking willpower. Primary care physicians (PCPs) also struggle to administer appropriate care, lacking time to go through preventive care in routine check-ups and sometimes receiving <10 hours of medical school training on obesity.

In addition to the enormous medical impact, obesity also places a significant financial burden on our healthcare system. The total annual cost of obesity in the U.S. is estimated at a staggering $1.4 trillion. This cost impacts all stakeholders throughout the healthcare continuum. Health plan members with an obesity diagnosis cost 2.7X more than members without a diagnosis, and there is an estimated $13.4-26.8B productivity loss due to obesity relative to those with a healthy weight.

Treatment for these conditions has historically included a mix of lifestyle changes (e.g., diet, exercise) and clinical treatments (e.g., anti-obesity medications, bariatric surgery). 95% of people who lose weight through dieting regain it, and a large share of people give up on their fitness goals within just one month. While consumers do benefit from these traditional approaches, many are left needing more. Recently, the emergence of GLP-1 drugs has been heralded as the answer to the obesity crisis, with one in five US adults with a BMI > 25 reporting having taken GLP-1 agonists. While these therapeutics have shown the ability to achieve meaningful near-term weight loss and improvement in other medical conditions, questions remain around the affordability and long-term efficacy of these treatments. Plans face an estimated $13K in net cost / year / patient in GLP-1 costs, and more than half of patients report difficultly affording the out-of-pocket costs of these treatments. This creates significant health equity concerns around access to these treatments. Further, 68% of patients discontinue their GLP-1 therapy within 12 months, and much of the weight loss can be due to muscle loss as opposed to fat. The long-term success of these therapeutics will be contingent on combining the offer with comprehensive, holistic care management.

Digital health technologies can help alleviate many of the hurdles that exist for consumers as they navigate weight issues. Stakeholders across the healthcare continuum are actively working to deploy new technologies to address the changing challenges associated with obesity. Pharma organizations are leveraging online pharmacy fulfillment services to go direct to consumer and improve access to medications. Providers are launching holistic telemedicine services that incorporate dieticians, wellness coaches, and physical therapists. Employers and health plans are partnering to offer integrated, coordinated, and holistic cardiometabolic care.

Though all individuals that live with obesity and excess weight face tremendous challenges, consumers’ specific health needs vary based on age, condition, and severity. To best outline weight management care gaps, 7wireVentures categorizes weight-challenged consumers into four distinct segments: Pediatric, Excess Weight, Class I and II Obesity, and Class III Obesity.

The unique characteristics of these consumer segments demonstrate consumers’ diverse needs across levels of disease acuity and the varied approaches to care required to meet these health needs. With a more multi-faceted approach driven by innovative technologies, the weight management care journey can be reconstructed to empower consumers to receive timely, personalized, and comprehensive care.

Weight Management Digital Health Landscape

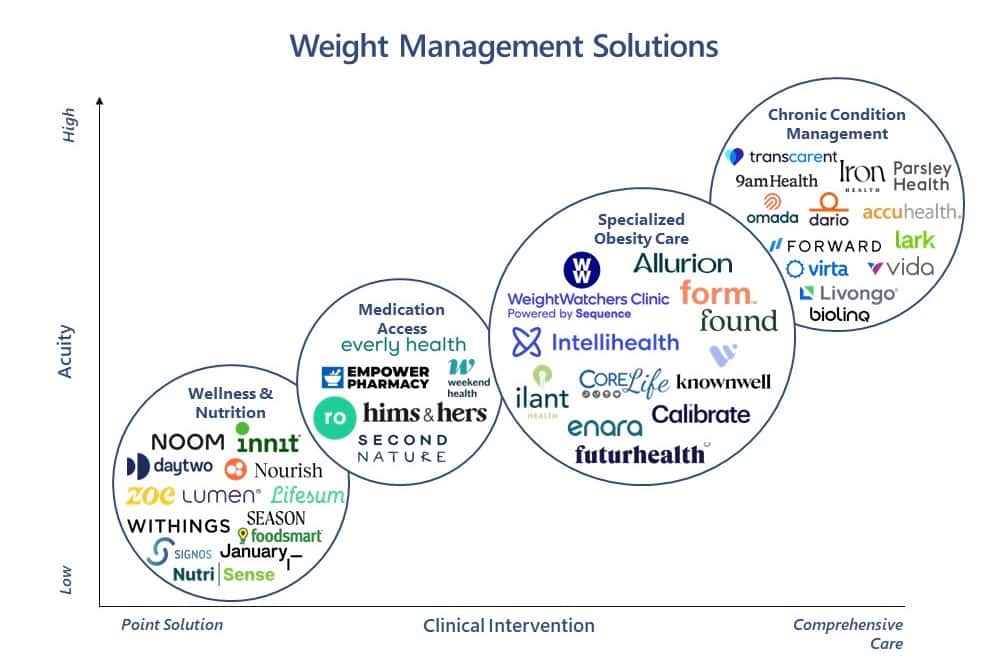

From specialized obesity care to wellness and nutrition products, investor interest in weight management has grown. Between 2020 and 2023, total investment exceeded $8B, with 2021 alone seeing a staggering $5.3B in private investment.1 We believe the weight management market landscape can be segmented into four different categories: Specialized Obesity Care, Chronic Condition Management, Diagnostics and Medication Access, Wellness and Nutrition.

[1] Pitchbook

Wellness and Nutrition: Digital health solutions can help patients drive sustained behavior change as it relates to diet and exercise – 45% of consumers use digital apps to manage their health and wellbeing. These solutions can be the primary intervention for many consumers (e.g., overweight), and are also likely adjunct to more comprehensive solutions for consumers with Class I, III, or III obesity. Companies are taking varied approaches to best enable consumers to use their data to achieve maximum impact. Noom, for example, offers daily lessons and access to one-on-one coaching as well as provides tracking tools that allow consumers to move at their desired pace. Signos, on the other hand, provides a continuous glucose monitoring wearable that helps consumers make decisions around food based on their metabolism throughout the day.

Diagnostics & Medication Access: One key challenge for consumers is the journey from receiving a diagnosis to receiving appropriate treatments. The high demand for GLP-1 products has led many companies to expand their existing telemedicine services to include access to GLP-1 prescriptions. Ro offers a Body program that combines access to GLP-1 drugs with personal coaching. Everly Health offers a Weight Care + program that combines access to GLP-1 drugs with access to licensed clinicians. However, one key concern with programs for medication access is the impact of informal channels (e.g., influencers), who may recommend providers who will issue prescriptions and provide tips on navigating insurance coverage. While this can be beneficial, not all the information is accurate or appropriate for a given consumer. Providers, health plans, and employers need to be aware of these channels and proactively ensure their patients are receiving accurate information.

Chronic Care Management: Obesity is strongly linked to other chronic conditions, including diabetes, hypertension, and heart disease. Up to 53% of new cases of Type 2 diabetes each year are linked to obesity, and weight-challenged consumers are more likely to have multiple comorbidities. As a result, many companies are expanding their chronic care management solutions to encompass weight care. 7wire portfolio company 9amHealth offers comprehensive cardiometabolic care, and members enrolled in its weight health program lost on average 14.5% of their body weight over 8 months. 7wire portfolio company Transcarent has partnered with 9amHealth to deliver comprehensive weight care, including lifestyle management, nutrition support, behavioral coaching, medication management, and bariatric care. Lark offers a diabetes prevention program that includes a mix of habit-building, coaching on medication management, and guidance from clinicians.

Specialized Obesity Care: Given the enormity of the challenge we face with obesity, it is no surprise that many companies are now positioning themselves as specialty obesity care providers. These programs often include a comprehensive care team featuring dieticians, therapists and coaching that provide a holistic approach to treatment. The stigma around obesity makes it all the more critical to be able to cultivate a deep patient-provider relationship and to demonstrate that providers are able to meet consumers where they are – 85% of consumers believe personalized care is important. Providers are taking a range of approaches to effectively serve consumers. Knownwell is an integrated obesity and primary care provider that includes both in-person and virtual care offerings. The company recently launched a teen-focused program as well. More recently, it acquired Alfie Health and plans to integrate Alfie’s AI-powered platform into the Knownwell care model. Ilant Health offers a multi-faceted care offering while leveraging its proprietary analytics engine to address coding gaps and identify members with the greatest clinical and financial value for treatments.

7wireVentures Predictions

PREDICTION 1: The emergence of high-cost anti-obesity medications and their growing consumer demand will push employers and payers to seek increasingly creative plan design structures that tackle weight management as a discrete disease category.

Given the high cost and high growth rates of obesity, employers and payers have significant concerns about the impact of GLP-1 spend. As such, we expect a focus on behavior change programs for consumers using high-cost medication to ensure appropriate adherence and drive lifestyle modification. We also anticipate an uptick in use of protocols that require members and employees to engage in holistic weight management programs before accessing high-cost anti-obesity medications. GLP-1 drugs will not be silver bullets, and plan designs will seek to maximize their efficacy while keeping costs under control.

PREDICTION 2: Greater emphasis will be placed on proactive identification and management of patients with an obesity diagnosis

Weight challenged patients are historically underdiagnosed and under identified, with 40% of patients with an obesity diagnosis lacking any documentation of their condition in their medical record. With the growth of outcome-oriented approaches and data-driven population targeting, we expect to see more solutions that proactively identify weight-challenged patients who are most likely to benefit from specific treatments tailored to their needs and personal situations. This will enable early interventions and potentially stem the need for high-cost medications down the road.

PREDICTION 3: Key differentiators of successful solutions will include long-term engagement and the ability to address multiple chronic conditions.

Obesity is intricately interwoven within a web of many chronic conditions. In today’s environment, payers and employers are increasingly experiencing point solution fatigue. This combination presents a salient market opportunity for solutions that can address multiple chronic conditions and take a holistic approach to health. This is true for both physical and mental health; mental health and obesity often co-occur and can exacerbate one another. Additionally, with the growth of value-based care, plans and employers will want to see demonstrable outcome improvement and cost reduction. This is only possible through sustained behavior change, which will require solutions that demonstrate an ability to foster long-term engagement with patients.

We have conviction that digital health solutions can be deployed to transform the end-to-end consumer care journey for those suffering from obesity and excess weight. Collaboration between investors, payers, providers, pharma, and policymakers can offer consumers and their families bias-free access to care that recognizes each individual’s needs, enabling them to take control over their diagnostic and care journeys.