Perspectives

Mastering the Money Game: The Basics of Startup Finances

Thanks to record numbers of recent M&A deals and the current tough financing environment, digital health investors are increasingly drawn to startups that can show a clear path to profitability. The “growth at all costs” mentality no longer holds water in this market – investors want to make sure that new businesses have a sound financial strategy that will carry the company to success. Not only are companies with strong fundamentals likely to have a higher likelihood of continuing success, they are also more likely to weather economic downturns. Cautionary tales include Quibi, which was led by Jeffrey Katzenberg and Meg Whitman to change the way content was consumed, raising $1.75B along the way. Quibi went out of business in just over two years and warns us of what happens when too much emphasis is put on a promising new product without first taking care of the basics.

While there is not just one path to successful business building, nor are there ever guarantees in the endeavor, businesses that weather the storm and stand the test of time have this in common: robust financial planning practices. Accordingly, one of our biggest aims at 7wire Ventures is to equip our portfolio companies with the right knowledge and tools to build these practices. We have shared with them the lessons from how other companies have successfully traversed difficult scenarios, and the key fundamentals to focus on. Below, we share five fundamentals and an extremely useful technique, “Back Casting.”

The 5 Fundamentals of Robust Financial Planning

#1 Unit Economics

As the name suggests, it is critical to start simple, at a unit level. Basic questions to ask (and solve) include: What is the right unit of measurement for your business? What are people buying? What is the cost to provide your product to the market?

When considering the costs per unit, many companies fail to include overarching costs that impact margins. For software products, unit costs should also include R&D and licensing. For companies focusing on devices, each company needs to decide whether the device should be considered a pass-through cost or whether it should be amortized as part of its service fees. For example, if a company is providing free glucose meters with their app subscription, as we did at Livongo, those would be part of the services provided and amortized accordingly. Note, however, the impact that has on cashflow since you are buying the meter to provide the service but not getting fully paid for it until you have recovered the cost through the subscription fee.

For any company, general administrative costs are often overlooked but should be included as part of your thinking about the cost to deliver your services – these G&A costs aren’t “free” and need to provide leverage to the business. Beyond the gross profit line, expenses like sales and marketing are critical to the business and should be considered within costs.

By answering these fundamental questions, companies can then decide what their ideal margins are and calculate prices accordingly.

#2 Pricing

As mentioned above, pricing must align with unit economics to build margins in an appropriate way. Ultimately, in the software business, companies should aim for gross margins in the 80%+ range and net margins at 50%+ range. Within the bundled product-plus-services category, net margins are typically lower, so prices should yield net margins in the 25-30% range. No matter what the calculus tells you, remember: customers must be willing to pay for the product at that price. Staying close to the market and demonstrating value to your customers is the ultimate test.

#3 Costs

There are 3 key elements to be aware of in properly managing costs:

- Tracking when costs are going to be incurred

- Aligning on payment schedules with suppliers

- Differentiating between internal costs to build vs. 3rd party servicing costs

Too many businesses spend huge sums of money up-front with the hopes that their volumes will grow in the future to support these bets. Instead, scrappy young businesses should be negotiating variable payments with their suppliers. Many suppliers will work with early-stage companies to give more beneficial payment terms, e.g., tiered pricing by volumes incurred. Remember, it never hurts to ask! Ballooning costs can often be the downfall of a company, even one with a great product and high customer acceptance. Companies that diligently manage costs ensure their unit costs don’t rise too quickly, so that they can smoothly scale to positive cash flow in later years.

#4 Cash Flows

Managing cash flows is a tricky balancing act between incoming cash from customers vs. outgoing to employees and suppliers. To help stabilize the company, there are several strategies that can be employed:

- To increase cash in, consider asking customers to pay upfront licensing or subscription fees. Even if a portion will be marked as deferred revenue, managing cash flows is significantly easier with this method than from asking for payment later.

- To increase cash in, contracts can be extended or re-negotiated – see more below.

- To decrease cash out, supplier payment schedules and/or terms can be negotiated as mentioned earlier.

- To decrease cash out, companies can think of creative ways to utilize options – many employees might be in a position to take less cash salary in return for shares.

#5 Customer Contracting

Customer contracts have a significant impact on cash flows, and companies should get smart on how to best create contracts beneficial to them. Contracts can be extended to multi-year customer agreements, which typically also lead to higher LTVs. These contracts also serve as proof of customer support and reduce the stress of constant revenue generation.

For customers who may not be willing to sign longer-term agreements, milestones or minimum timelines can be added to the terms. For example, a customer might insist on an early termination clause – in order to consider such a provision, be sure to have a minimum payment that will cover the start-up cost of that relationship (which could take the form of a minimum number of months that have to be paid for with respect to all users). Within payor contracts especially, companies must ensure alignment on the objectives and have a shared understanding of what data is being used to track ROI. (That data should also be accessible for the company to course correct as needed.) Your sales team should know what deal terms are fixed and which terms can be bent.

Within the world of contracts, it’s always better to take a “yes, if” approach rather than a “no, we can’t” approach – the key is to find solutions to make the pricing work for all concerned.

Bringing it all together: Creating planning horizons with “Back Casting”

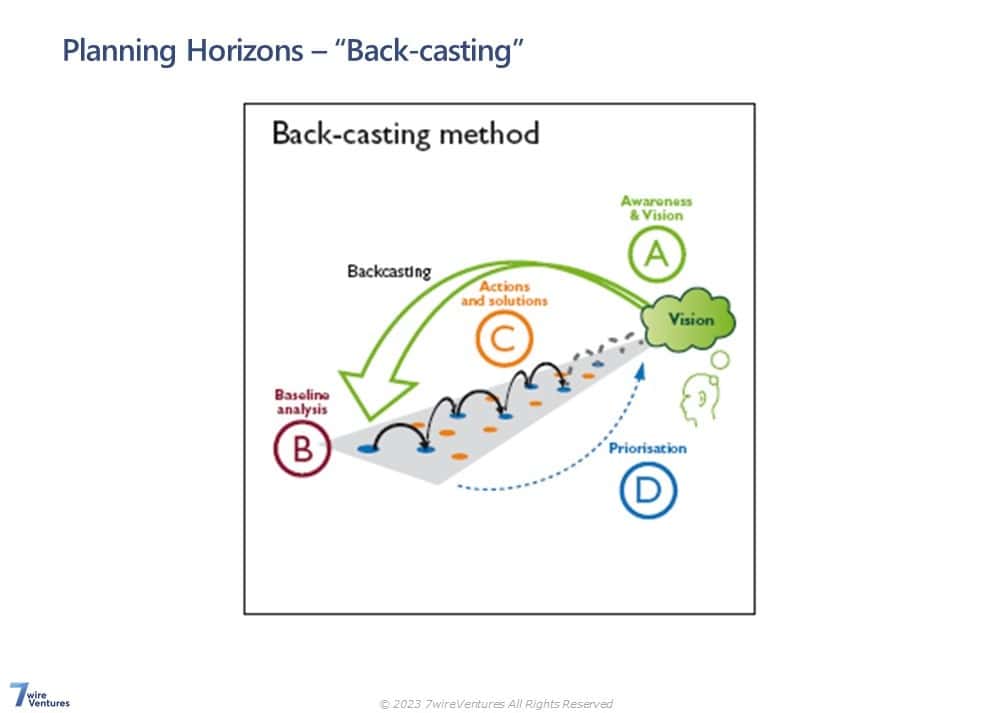

One of the biggest challenges with financial planning is balancing both short- and long-term goals. To reach a future state from the current one, leaders can use the powerful Back Casting Framework. Back Casting helps company leaders think through not only what an ideal future state would look like, but also how to get there and what changes must be made to the business to reach that point. There are 4 steps to back casting the future vision:

- Step A: Decide on the company’s vision for the future and what the circumstances will look like at that point in time. For example, to raise $40M in Q3 of next year, what will the company’s revenue run rate look like? What will the multiples look like? How will macro-economic conditions affect the company?

- Step B: Map from that future vision to the current state by looking at funding to date, current cash flows, and existing customers. With this mapping, adjustments can be made if the vision target is too ambitious or not ambitious enough.

- Step C: After deciding the right baseline and future vision, break down the steps to achieve that target and an action plan to reach the ultimate goal.

- Step D: To manage this path to the future state vision, the team must align on which actions need to be prioritized and how to do so.

Beyond aiding in future planning, the Back Casting framework also forces a gut-check on the current state of your business and what is feasible based on projections. This same framework can be used for both revenues and costs – in terms of costs, the actions include considering additional costs needed to scale. Ultimately, by back casting, growing companies can better plan the steps needed to attain their financial goals.

“If you don’t know where you are going, any road will get you there.”

Building a business is a challenging endeavor to even the most seasoned of entrepreneurs. This complexity is why it is so critical to have robust financial planning. After all, as Lewis Carroll once said, “if you don’t know where you are going, any road will get you there.” By utilizing the back casting framework and paying close attention to these 6 key financial fundamentals, startup founders can significantly increase the probability of successfully growing their companies from soon-icorns to unicorns.